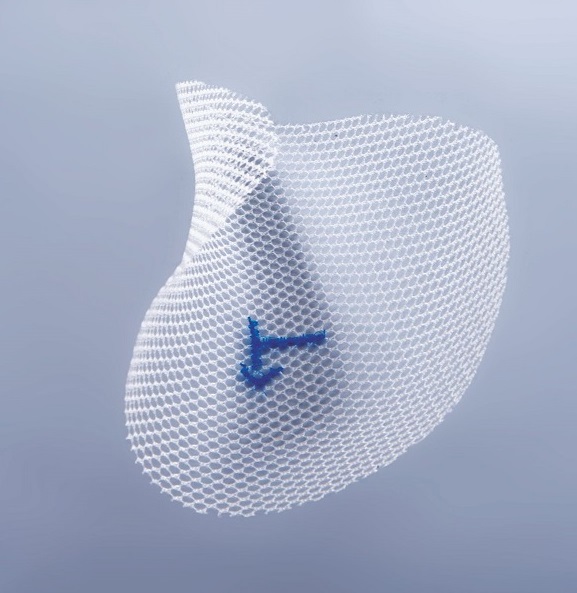

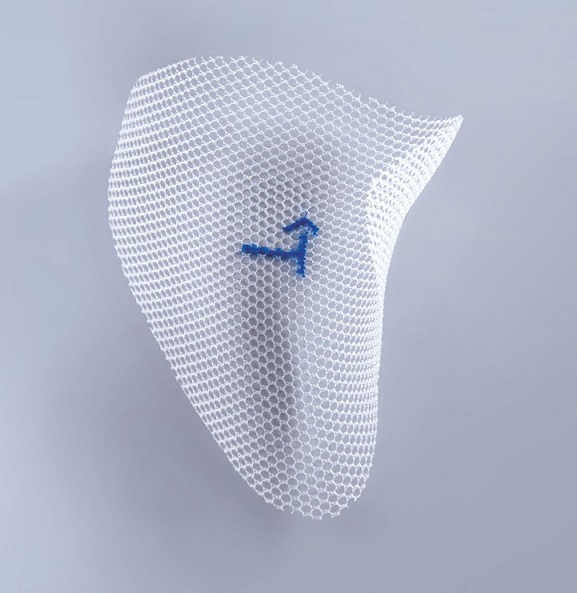

Siatka chirurgiczna (przepuklinowa) anatomiczna, częściowo wchłanialna, kompozytowa PROMESH® ABSO ANAT – Sklep Medyczny Madens

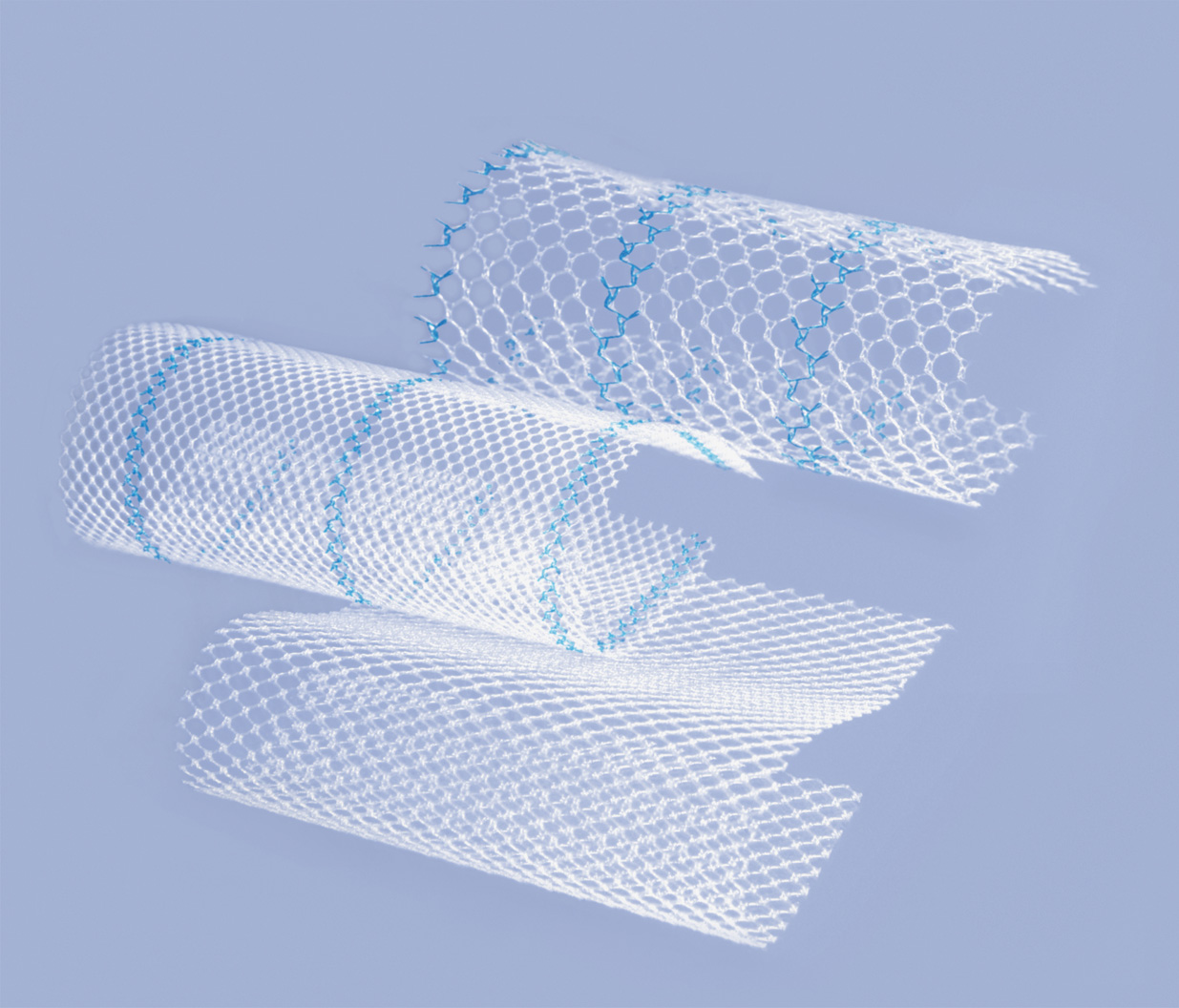

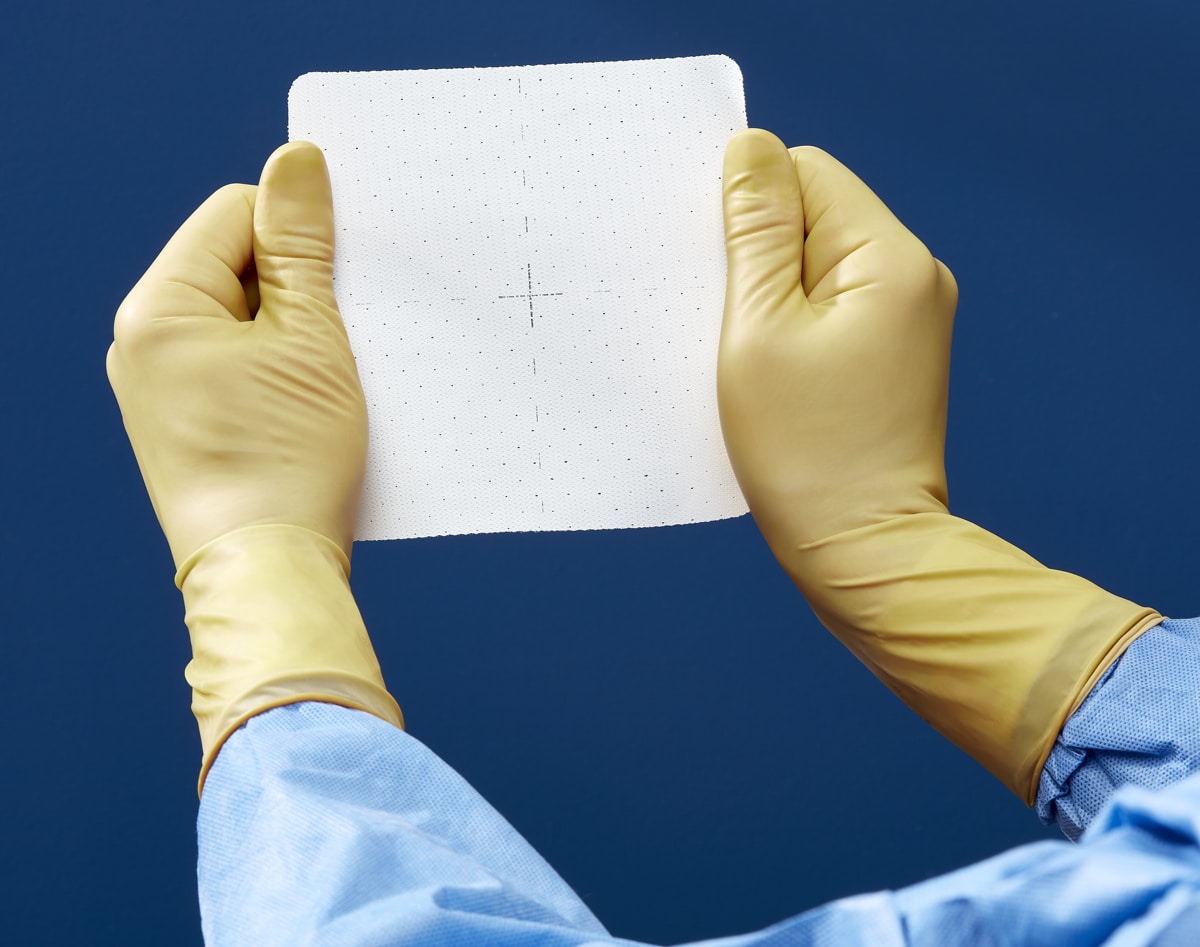

Dwustronna siatka chirurgiczna (przepuklinowa) polipropylenowa PROMESH® SURG INTRA – Sklep Medyczny Madens

Wyprzedaż! 1 szt. Chirurgiczna Tatuaż Brwi, Znacznik Dla Skóry, Narzędzia Do Микроблейдинга, Akcesoria Do Pozycjonowania, Uchwyt Do Tatuażu, Linijka, Makijaż permanentny - Zdrowie I Uroda ~ Lkssygnal.pl

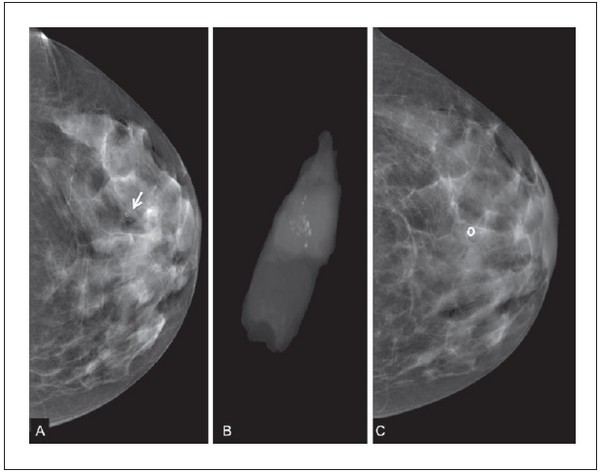

W jaki sposób oraz u kogo stosować znaczniki po biopsji piersi? - Diagnostyka - Rak piersi - Nowotwory - Onkologia - Medycyna Praktyczna dla lekarzy

Dwustronna siatka chirurgiczna (przepuklinowa) polipropylenowa PROMESH® SURG INTRA – Sklep Medyczny Madens

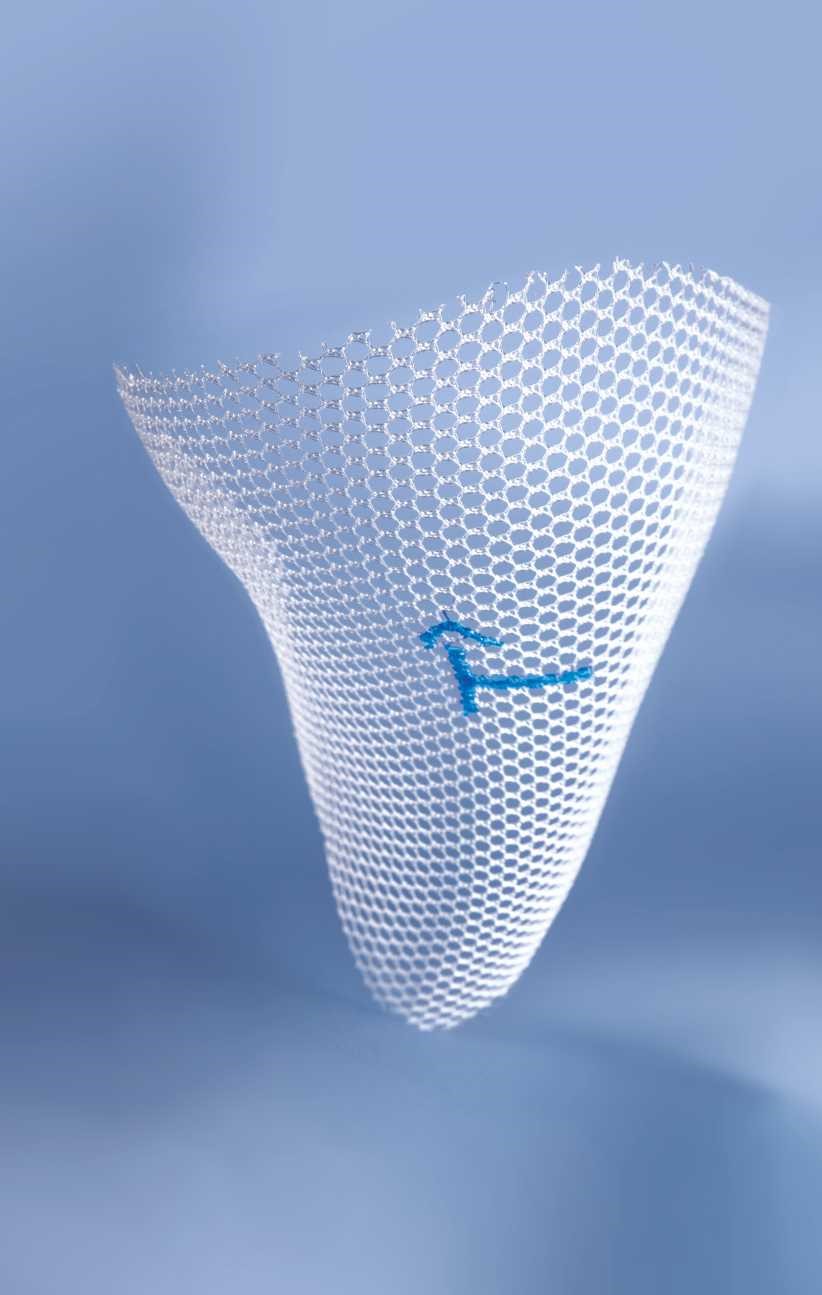

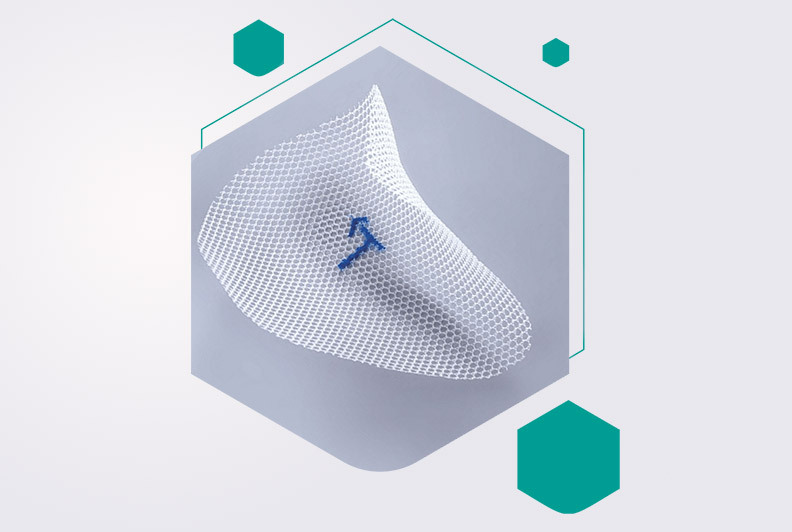

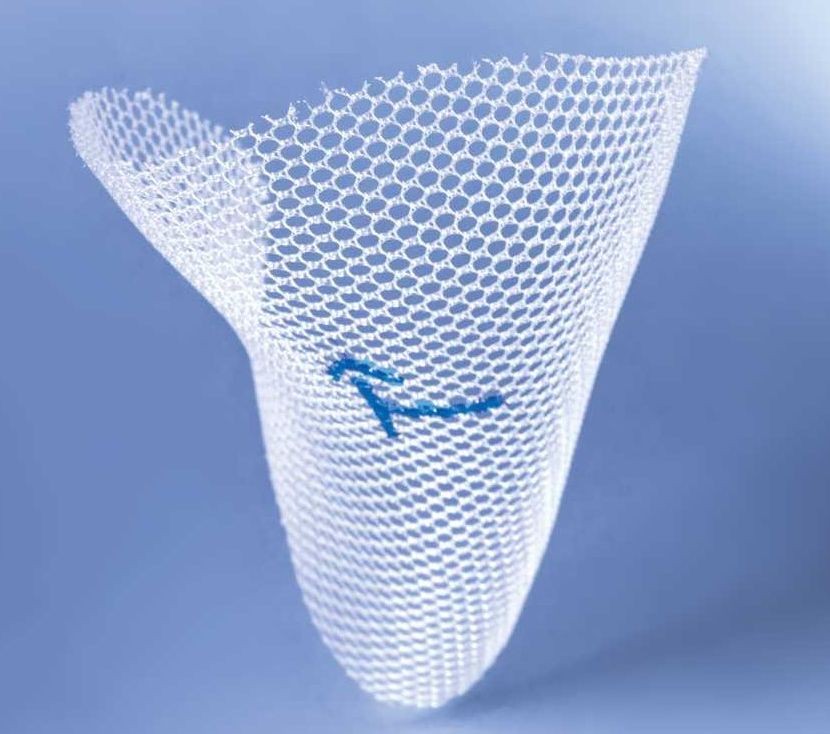

Innowacyjna operacja przepukliny pachwinowej z użyciem personalizowanego IMPLANTU OPTOMESH 3D ILAM - Szpital Matopat

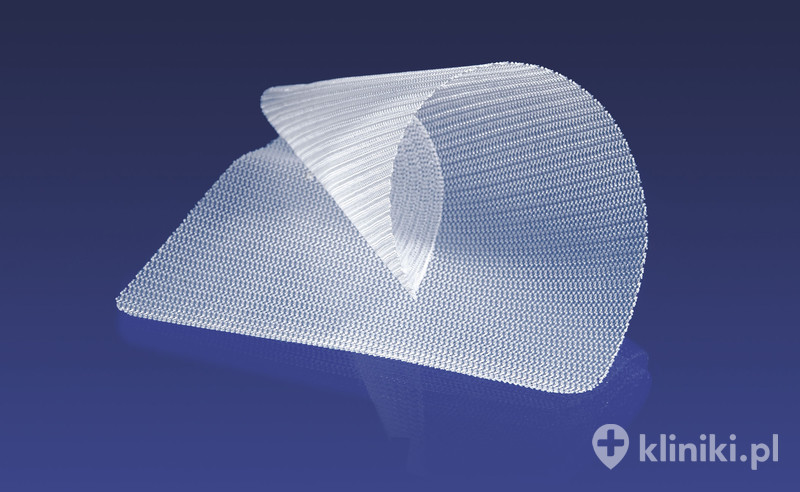

Lekka siatka chirurgiczna (przepuklinowa) częściowo wchłanialna, kompozytowa PROMESH® ABSO – Sklep Medyczny Madens

Lekka siatka chirurgiczna (przepuklinowa) częściowo wchłanialna, kompozytowa PROMESH® ABSO – Sklep Medyczny Madens

Polscy naukowcy opracowali innowacyjny implant przepuklinowy. Pierwsze wszczepienie już 14 września | KopalniaWiedzy.pl

Siatka chirurgiczna (przepuklinowa) anatomiczna, częściowo wchłanialna, kompozytowa PROMESH® ABSO ANAT – Sklep Medyczny Madens

CITEC: Siatki przepuklinowe. Protezy jelitowe/tchawicze. Staplery chirurgiczne. - Protezy tchawicze - Y kształtu protezy tchawicze

2 szt wodoodporna kredka do tatuażu микроблейдинг chirurgicznie znacznik dla skóry uchwyt do brwi kredka do ust, makijaż permanentny pozycjonowanie uchwyt na akcesoria rabat | Tatuaż i body art ~ Marzotko.pl