Swarovski Kette mit Anhänger »Herz, Infinity Heart, weiss, Metallmix, 5518868«, mit Swarovski® Kristallen bestellen | BAUR

Swarovski Kette mit Anhänger »Herz, Infinity Heart, weiss, Metallmix, 5518868«, mit Swarovski® Kristallen bestellen | BAUR

Damen Halskette mit Swarovski Steinen besetzt Herz Anhänger | Seilershop.com - immer genau das Richtige!

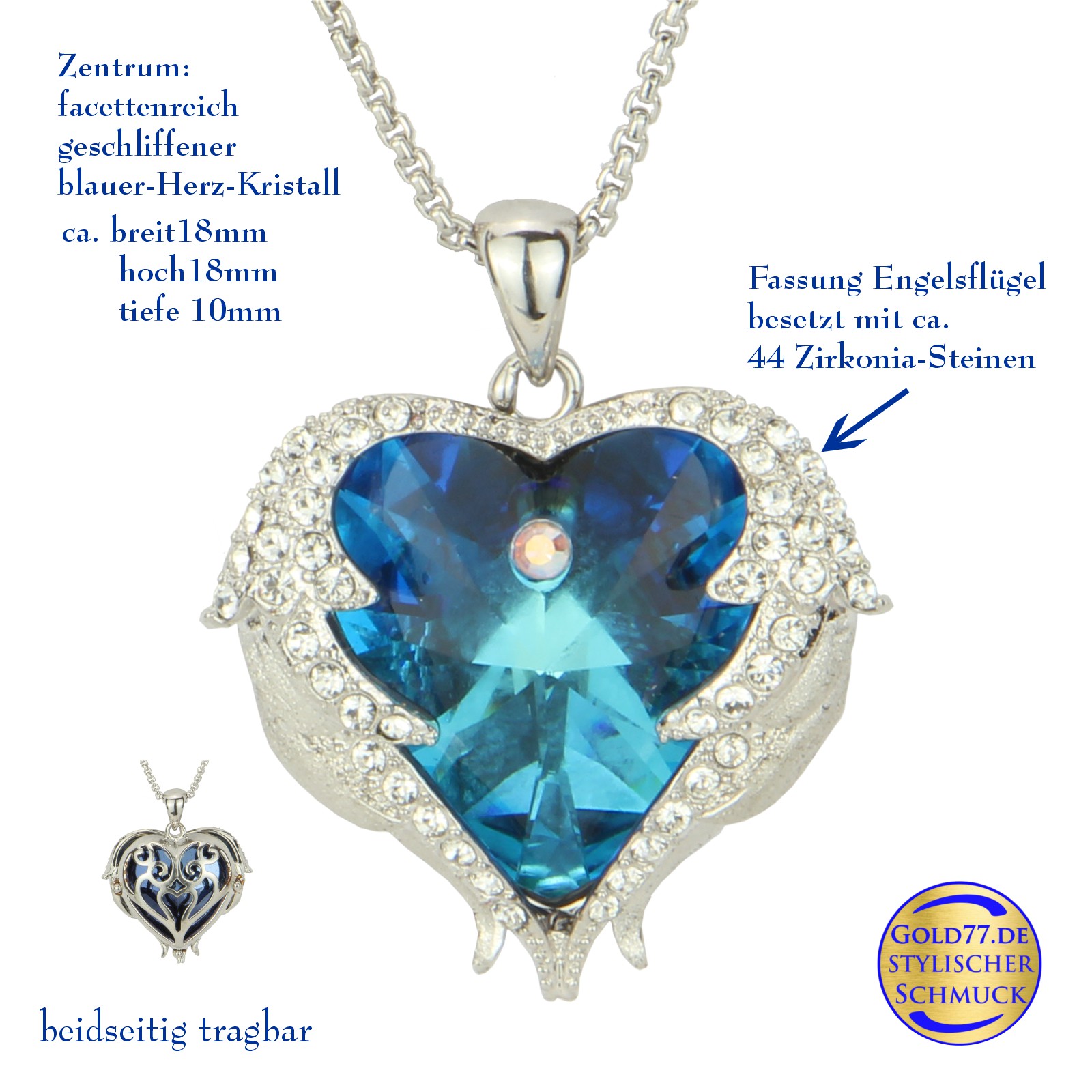

Halskette Blaues Herz mit Swarovski Kristallen Zirkonia Kette 45cm plus 5cm Verlängerung | Gold77.de | Stylischer Schmuck

Damen Halskette 925 Sterling Silber mit SWAROVSKI ELEMENTS Herz Anhänger Blue AB Herz und individueller Namensgravur : Amazon.de: Fashion