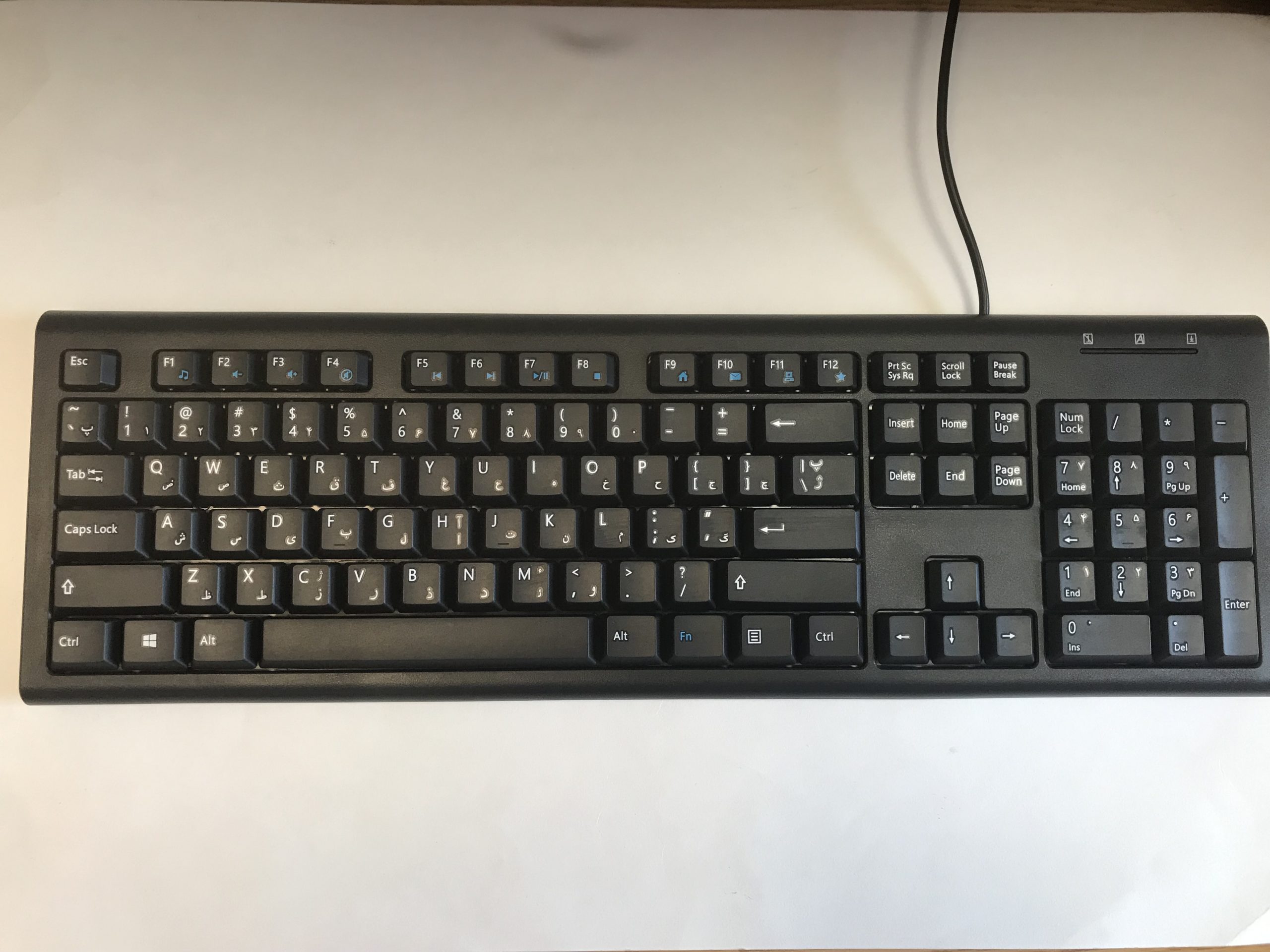

Buy HRH Persian Farsi Language Silicone Keyboard Cover Skin for MacBook Air 13,for MacBook Pro 131517with or wOut Retina Display,2015 or Older Version&for iMac Older USA Keyboard Protector-Black Online at Lowest Price

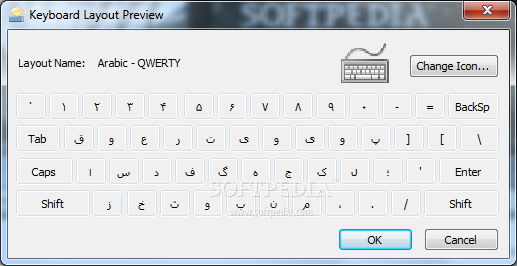

Komeil's Persian Keyboard Layout (kbdfa.dll) and Installer for Windows Vista and Windows Server 2008 - Komeil Bahmanpour

Amazon.com: FARSI (Persian) Keyboard Labels Orange Lettering ON Transparent Background for Desktop, Laptop and Notebook : Electronics

Amazon.com: FARSI (Persian) with White Letters Keyboard Stickers Transparent for Computers LAPTOPS Desktop Keyboards : Electronics

HRH Eco friendly Arabic Alphabet Soft Silicone Persian Keyboard Protective Film Cover Skin for Mac Book Air Pro Retina 13 15 17|persian keyboard| keyboard cover skinsilicon keyboard skin - AliExpress